Federal Budget 2025: 9 Key Changes & Financial Impact Analysis

Anúncios

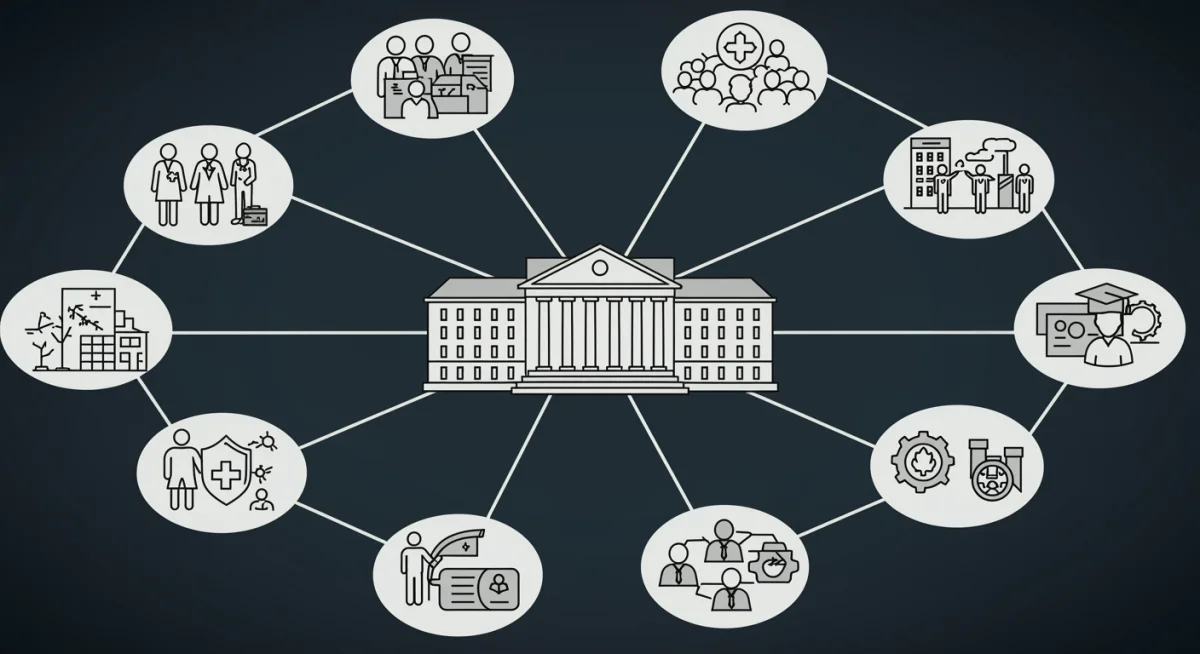

The 2025 Federal Budget Proposal outlines significant shifts in spending and revenue, impacting critical sectors from healthcare and education to defense and climate initiatives, alongside adjustments in taxation and social programs.

Anúncios

Understanding the implications of the latest Federal Budget 2025 Analysis is crucial for every American, as it directly shapes the nation’s economic landscape and future. This proposal, a blueprint for federal spending and revenue, introduces significant changes that will reverberate across various sectors, from individual households to major industries.

Anúncios

Understanding the 2025 Federal Budget Landscape

The 2025 Federal Budget Proposal represents a comprehensive strategic vision for the nation’s fiscal future, reflecting both current economic realities and long-term policy objectives. It’s more than just a ledger of income and expenses; it’s a statement of priorities, outlining where federal resources will be directed and how they will be generated. This year’s proposal comes amidst a complex global economic environment, characterized by ongoing inflation concerns, geopolitical tensions, and the continued need for robust domestic investment.

The budget aims to strike a delicate balance between fiscal responsibility and addressing pressing societal needs. It seeks to reduce the national debt over the long term while simultaneously investing in areas deemed critical for sustainable growth and national security. Such ambitious goals necessitate careful consideration of every line item, from defense spending to social safety nets, and from scientific research to infrastructure development. The proposal attempts to navigate these intricate challenges by proposing targeted investments and revenue-generating measures designed to improve the nation’s economic health and competitiveness.

Ultimately, the 2025 Federal Budget is a living document, subject to extensive debate and negotiation within Congress. Its initial presentation marks the beginning of a lengthy legislative process where various stakeholders will advocate for their interests. The final approved budget may differ significantly from the initial proposal, but understanding these early proposals is essential for anticipating the direction of federal policy and its potential impacts on the lives of ordinary citizens and businesses alike.

Healthcare Reform and Funding Adjustments

One of the most significant aspects of the 2025 Federal Budget Proposal involves substantial changes to healthcare policies and funding mechanisms. The administration has laid out plans to both expand access to care and control rising costs, a perennial challenge in the American healthcare system. These proposals touch upon various facets of healthcare, from prescription drug pricing to the funding of federal health programs like Medicare and Medicaid.

Prescription Drug Cost Reduction Initiatives

The budget proposes aggressive measures aimed at lowering prescription drug costs for consumers. This includes expanding the government’s ability to negotiate drug prices, a power currently limited, and implementing caps on out-of-pocket expenses for certain medications. The financial impact of these changes could be substantial, potentially easing the burden on millions of Americans and leading to significant savings for federal health programs.

- Expanded Medicare drug price negotiation authority.

- Caps on out-of-pocket prescription drug costs for seniors.

- Incentives for generic drug development and market entry.

Beyond drug costs, the budget also addresses the long-term solvency of Medicare and Medicaid. Proposals include adjustments to provider reimbursement rates and initiatives to promote value-based care models, shifting away from fee-for-service. These changes are designed to ensure the sustainability of these vital programs while maintaining quality of care for beneficiaries.

The proposed healthcare reforms aim to create a more equitable and affordable system. While the specifics are still subject to legislative review, the direction is clear: a concerted effort to curb healthcare expenditures while enhancing access and quality. The financial implications for pharmaceutical companies, healthcare providers, and individual patients will be closely watched as these proposals move through Congress.

Education Investment and Workforce Development

The 2025 Federal Budget places a strong emphasis on education and workforce development, recognizing these as critical pillars for future economic prosperity and global competitiveness. The proposals seek to address persistent disparities in educational outcomes and equip the American workforce with the skills needed for a rapidly evolving job market. Significant investments are earmarked for early childhood education, K-12 schools, higher education, and vocational training programs.

Boosting Early Childhood and K-12 Education

A key focus is on expanding access to high-quality early childhood education, including increased funding for Head Start programs and universal pre-kindergarten initiatives. For K-12 education, the budget proposes substantial increases in Title I funding, which supports schools serving low-income students. These investments are intended to narrow achievement gaps and provide foundational learning opportunities for all children, regardless of their socioeconomic background. The financial impact here could be transformative for local school districts, enabling them to hire more teachers, improve facilities, and implement innovative learning strategies.

- Increased funding for Head Start and pre-kindergarten programs.

- Significant boost in Title I funding for underserved K-12 schools.

- Grants for teacher recruitment and retention in critical areas.

Furthermore, the budget addresses the affordability and accessibility of higher education. Proposals include increasing the maximum Pell Grant award, which provides financial aid to low-income undergraduate students, and investing in initiatives to reduce student loan debt. For workforce development, there’s a strong push for funding career and technical education (CTE) programs, apprenticeships, and job training initiatives tailored to high-demand industries. These measures aim to bridge the skills gap and provide direct pathways to stable, well-paying jobs, thereby strengthening the overall economy.

Defense Spending and National Security Priorities

The 2025 Federal Budget Proposal dedicates a substantial portion of its resources to defense spending and national security, reflecting ongoing geopolitical challenges and the need to maintain a strong military posture. The proposed allocations aim to modernize military capabilities, enhance readiness, and invest in next-generation technologies to counter evolving threats. This area typically draws significant debate, balancing strategic imperatives with fiscal constraints.

Key investments are slated for research and development (R&D) in critical areas such as artificial intelligence, cyber warfare, and advanced weaponry. The budget also prioritizes maintaining and upgrading existing equipment, ensuring that military branches have the resources necessary for effective operations both domestically and abroad. The financial impact of these decisions extends beyond the Department of Defense, influencing defense contractors, technology firms, and various research institutions across the country.

Modernization of Military Capabilities

A significant portion of the defense budget is allocated to modernizing the armed forces. This includes funding for new aircraft, naval vessels, and ground combat systems, designed to replace aging platforms and introduce more advanced capabilities. Cybersecurity defenses are also a major focus, with increased investments to protect critical infrastructure and combat cyber threats from state and non-state actors.

- Funding for next-generation fighter jets and naval assets.

- Enhanced investments in cybersecurity and space capabilities.

- Resources for troop readiness and training exercises.

Moreover, the budget includes provisions for supporting military families, improving healthcare for veterans, and investing in diplomatic efforts that complement military strategy. The overall aim is to ensure the United States remains a global leader in defense, capable of protecting its interests and allies while adapting to a dynamic international security landscape. The financial implications are massive, supporting a vast ecosystem of industries and personnel.

Climate Change Initiatives and Green Investments

Addressing climate change and promoting a green economy are central themes in the 2025 Federal Budget Proposal, signaling a continued commitment to environmental sustainability and renewable energy. The budget outlines significant investments in clean energy technologies, climate resilience, and conservation efforts, aiming to reduce greenhouse gas emissions and foster economic growth in emerging green industries. This focus reflects both scientific urgency and a strategic economic vision.

Proposed funding includes tax credits and grants for renewable energy projects, such as solar and wind power, as well as incentives for electric vehicle manufacturing and charging infrastructure. These initiatives are designed to accelerate the transition away from fossil fuels, create new jobs in the clean energy sector, and reduce energy costs for consumers in the long run. The financial impact is expected to stimulate private sector investment and foster innovation in sustainable technologies.

Investing in Renewable Energy and Infrastructure

The budget allocates substantial resources to developing and deploying renewable energy solutions. This involves not only direct funding for projects but also investments in research and development to improve energy storage, grid modernization, and carbon capture technologies. Furthermore, there’s a strong emphasis on building resilient infrastructure capable of withstanding the impacts of climate change, such as extreme weather events.

- Expanded tax credits for solar, wind, and other renewable energy sources.

- Funding for electric vehicle charging station deployment nationwide.

- Investments in climate-resilient infrastructure projects.

Beyond energy, the budget also supports conservation programs, aiming to protect natural habitats, restore ecosystems, and promote sustainable land management practices. These environmental initiatives are framed not just as ecological necessities but as opportunities for economic development, job creation, and fostering a healthier future for all Americans. The financial commitment underscores a long-term strategy to integrate environmental stewardship with economic policy.

Infrastructure Modernization and Public Works

The 2025 Federal Budget Proposal continues to prioritize significant investments in infrastructure modernization and public works, recognizing their vital role in supporting economic growth, improving public safety, and enhancing the quality of life for communities across the nation. These investments span a broad range of projects, from repairing aging roads and bridges to expanding broadband internet access and upgrading public transit systems. The goal is to build a more resilient and efficient national infrastructure that can meet the demands of the 21st century.

A substantial portion of the allocated funds is directed towards repairing and upgrading existing infrastructure networks. This includes addressing the backlog of maintenance needs for highways, railways, and water systems, which have suffered from decades of underinvestment. The financial impact of these projects is multifaceted, creating numerous jobs in construction and related industries, stimulating local economies, and improving the efficiency of supply chains and transportation networks.

Expanding Broadband and Public Transit

Beyond traditional infrastructure, the budget places a strong emphasis on expanding access to high-speed broadband internet, particularly in rural and underserved areas. This initiative aims to bridge the digital divide, ensuring that all Americans have access to essential online services for education, work, and healthcare. Similarly, investments in public transit systems are designed to offer more sustainable and accessible transportation options, reducing traffic congestion and emissions in urban centers.

- Increased funding for repairing and upgrading national highways and bridges.

- Significant investment in expanding broadband internet access to rural communities.

- Modernization and expansion of public transportation networks.

These infrastructure projects are not merely about physical construction; they are about laying the groundwork for future economic competitiveness and social equity. By improving connectivity, transportation, and essential services, the budget aims to unlock new opportunities for businesses and individuals, ensuring that the nation’s infrastructure can support sustained growth and innovation for decades to come. The financial commitment reflects a strategic long-term vision for national development.

Tax Policy Changes and Revenue Generation

The 2025 Federal Budget Proposal includes several significant tax policy changes aimed at generating revenue, enhancing fairness, and incentivizing specific economic behaviors. These proposals touch upon corporate taxation, high-income individuals, and various tax credits, reflecting the administration’s broader economic and social objectives. Understanding these changes is crucial for businesses and individuals as they anticipate their future tax obligations and opportunities.

One of the primary goals of the proposed tax changes is to ensure that corporations and the wealthiest Americans contribute their fair share to the national revenue. This includes proposals to increase the corporate tax rate from its current level and to raise taxes on capital gains and high-income earners. The financial impact of these adjustments is projected to significantly increase federal revenue, which can then be used to fund other budget priorities and reduce the national deficit.

Targeted Tax Credits and Incentives

In addition to revenue-generating measures, the budget also proposes new or expanded tax credits designed to encourage specific activities. These include credits for clean energy investments, affordable housing development, and families with children. Such incentives aim to stimulate economic growth in desired sectors and provide financial relief to specific demographic groups, aligning tax policy with broader social goals.

- Proposed increase in the corporate tax rate.

- Higher taxes on capital gains for high-income individuals.

- Expanded tax credits for clean energy and family support.

The proposed tax changes are likely to be a major point of contention during the legislative process, with debates centering on their potential effects on economic growth, investment, and income distribution. While proponents argue for their role in fiscal responsibility and social equity, critics may raise concerns about their impact on competitiveness and job creation. The ultimate shape of these tax policies will significantly influence the financial landscape for many stakeholders.

Social Programs and Safety Net Enhancements

The 2025 Federal Budget Proposal reinforces the government’s commitment to strengthening social programs and enhancing the nation’s safety net, aiming to provide greater support for vulnerable populations and reduce poverty. These proposals encompass a range of initiatives, including adjustments to Social Security, increased funding for food assistance programs, and expanded access to affordable housing. The overarching goal is to ensure that all Americans have access to basic necessities and opportunities for economic mobility.

A key focus is on bolstering Social Security and Medicare, ensuring their long-term solvency for future generations. While specific structural reforms might be debated separately, the budget generally supports measures to maintain the integrity and benefits of these foundational programs. Increased funding is also proposed for programs that address food insecurity, such as the Supplemental Nutrition Assistance Program (SNAP), aiming to alleviate hunger and improve health outcomes for low-income families.

Affordable Housing Initiatives and Child Care Support

The budget allocates significant resources to expanding access to affordable housing, a critical need in many communities. This includes funding for rental assistance programs, initiatives to build more affordable housing units, and support for homeless assistance services. Additionally, there are proposals to make child care more affordable and accessible for working families, recognizing its importance for both child development and parental workforce participation.

- Commitment to strengthening Social Security and Medicare.

- Increased funding for SNAP and other food assistance programs.

- Investments in affordable housing and rental assistance programs.

These enhancements to social programs and the safety net are designed to create a more inclusive and equitable society, where individuals and families have the support they need to thrive. The financial impact is intended to provide immediate relief to those in need while also fostering long-term stability and reducing economic disparities across the country. These proposals underscore a belief in collective responsibility and the importance of a robust social infrastructure.

Research and Development in Key Sectors

The 2025 Federal Budget Proposal emphasizes substantial investments in research and development (R&D) across various key sectors, recognizing innovation as a primary driver of economic growth, national security, and societal well-being. This commitment to R&D aims to maintain America’s leadership in science and technology, fostering breakthroughs that can address global challenges and create new industries. Funding is directed towards government agencies, universities, and private sector partnerships.

Significant allocations are proposed for scientific research in areas such as advanced computing, biotechnology, space exploration, and clean energy. These investments are crucial for pushing the boundaries of knowledge and translating scientific discoveries into practical applications. The financial impact of increased R&D funding extends to job creation in high-tech fields, intellectual property development, and enhanced competitiveness on the global stage.

Advancing Artificial Intelligence and Biotechnology

A particular focus is placed on advancing research in artificial intelligence (AI) and biotechnology, two fields with transformative potential. The budget aims to accelerate the development of ethical AI applications and to support groundbreaking research in genomics, personalized medicine, and disease prevention. These strategic investments are intended to secure future economic advantages and improve public health outcomes.

- Increased funding for AI research and development.

- Support for biotechnology and genomic research initiatives.

- Investments in space exploration and next-generation computing.

Beyond specific technological fields, the budget also supports foundational scientific research that may not have immediate commercial applications but is essential for long-term innovation. By fostering a vibrant research ecosystem, the federal government seeks to cultivate a pipeline of talent and ideas that will continue to fuel American ingenuity for decades to come. The financial commitment to R&D is therefore viewed as an investment in the nation’s future prosperity and capacity for problem-solving.

Economic Impact and Fiscal Responsibility

The 2025 Federal Budget Proposal intricately weaves together spending and revenue measures with an eye toward broader economic impact and long-term fiscal responsibility. Every allocation and tax adjustment is presented with an estimation of its effect on inflation, economic growth, employment, and the national debt. The administration’s stated goal is to achieve a balance that promotes robust economic activity while also putting the nation on a more sustainable fiscal path.

The budget projects a reduction in the national deficit over the coming decade through a combination of increased revenues from tax policy changes and targeted spending cuts or efficiencies. These projections are often subject to intense scrutiny and debate, as economic forecasts can vary widely. However, the intent is clear: to demonstrate a commitment to fiscal prudence amidst significant investments in national priorities. The financial impact of these efforts, if successful, could include greater investor confidence and lower long-term borrowing costs for the government.

Inflation Management and Economic Growth

A key aspect of the budget’s economic strategy is its approach to inflation. While some spending initiatives might initially raise concerns about inflationary pressures, the administration argues that targeted investments in supply chain resilience, clean energy, and healthcare cost reduction will ultimately help to lower prices for consumers. Simultaneously, the budget aims to foster sustainable economic growth by investing in human capital, infrastructure, and innovation, creating a virtuous cycle of productivity and prosperity.

- Projected reduction in the national deficit over ten years.

- Emphasis on investments designed to mitigate inflationary pressures.

- Strategies to stimulate long-term economic growth and job creation.

Ultimately, the success of the 2025 Federal Budget in achieving its economic and fiscal goals will depend on its implementation and the broader economic environment. It represents a strategic attempt to navigate complex financial challenges, balancing immediate needs with long-term aspirations. The financial performance of the nation under this proposed budget will be a critical measure of its effectiveness and its contribution to the well-being of American citizens.

| Key Area | Brief Description |

|---|---|

| Healthcare Reform | Proposals to lower drug costs and ensure Medicare/Medicaid solvency. |

| Education & Workforce | Increased funding for early childhood, K-12, higher education, and job training. |

| Climate Initiatives | Investments in clean energy, climate resilience, and conservation efforts. |

| Tax Policy | Changes in corporate and high-income taxes, alongside new tax credits. |

Frequently Asked Questions About the 2025 Federal Budget

The 2025 Federal Budget Proposal aims to balance fiscal responsibility with strategic investments. Key goals include reducing the national debt, fostering economic growth, addressing climate change, enhancing national security, and strengthening social safety nets through targeted spending and revenue adjustments.

The budget proposes several measures to tackle healthcare costs, such as expanding the government’s ability to negotiate prescription drug prices, capping out-of-pocket expenses for certain medications, and promoting value-based care models to ensure the long-term solvency of programs like Medicare and Medicaid.

Significant investments are earmarked for expanding early childhood education, increasing Title I funding for K-12 schools, raising Pell Grant awards for higher education, and boosting funding for vocational training and apprenticeship programs to meet evolving job market demands.

The budget proposes an increase in the corporate tax rate and higher taxes on capital gains for high-income individuals. It also includes new or expanded tax credits for clean energy investments, affordable housing development, and families with children, aiming for revenue generation and targeted incentives.

The budget allocates substantial resources to climate change initiatives, including tax credits and grants for renewable energy projects, incentives for electric vehicle infrastructure, and investments in climate resilience and conservation efforts, aiming to reduce emissions and foster a green economy.

Conclusion

The 2025 Federal Budget Proposal is a comprehensive document that lays out the administration’s vision for the nation’s future, touching upon virtually every aspect of American life and economy. From significant shifts in healthcare and education funding to ambitious plans for climate action and infrastructure modernization, the budget reflects a strategic effort to address current challenges while investing in long-term prosperity. While the legislative process will undoubtedly bring modifications, understanding these initial key takeaways provides essential insight into the direction of federal policy and its potential financial impact on individuals, businesses, and communities across the United States. It underscores a commitment to balancing fiscal prudence with the pursuit of a more equitable, secure, and sustainable future.