Credit Card Minimum Payments: The Hidden Cost of 3% by 2026

Anúncios

Paying only the minimum on your credit card can lead to significant financial strain, accumulating thousands in interest and extending debt for years.

Anúncios

Have you ever looked at your credit card statement and seen that small, seemingly manageable number labeled ‘Minimum Payment Due’? It might look like a lifeline, an easy way to keep your head above water financially. However, focusing solely on credit card minimum payments, especially if it’s as low as 3%, can lead to a deceptive and costly trap that could leave you thousands of dollars poorer by 2026. This isn’t just about paying a little extra; it’s about understanding the profound long-term implications for your financial well-being.

Anúncios

The Illusion of Affordability: What Minimum Payments Truly Mean

Many credit card users view the minimum payment as the ‘safe’ option, the bare essential to avoid late fees and maintain a good credit score. However, this perception can be dangerously misleading. The minimum payment is often calculated as a small percentage of your outstanding balance, typically between 1% and 3%, plus any accrued interest and fees.

While this keeps your account current, it does very little to tackle the principal debt. Credit card companies structure these payments to ensure they recoup their interest first, meaning a large portion of your minimum payment goes directly into their pockets, leaving your actual debt largely untouched. This cycle can extend for years, turning a seemingly small balance into a prolonged financial burden.

Understanding the Calculation

The exact formula for minimum payments varies by issuer and card agreement. However, a common structure involves a percentage of the balance (e.g., 2% or 3%) or a fixed amount (e.g., $25), whichever is greater, plus interest and fees. This structure means that as your balance decreases, so too does your minimum payment, making it even harder to pay off the principal.

- Low Percentage: Often 1-3% of the outstanding balance.

- Interest First: A significant portion covers interest charges.

- Principal Stagnation: Very little goes towards reducing the actual debt.

- Extended Debt: Leads to many years of payments for a single purchase.

Ultimately, the illusion of affordability created by low minimum payments is a primary reason why so many individuals find themselves struggling with credit card debt. It disguises the true cost of borrowing, making it easy to underestimate the time and money required to become debt-free.

The Compounding Interest Trap: How Debt Explodes

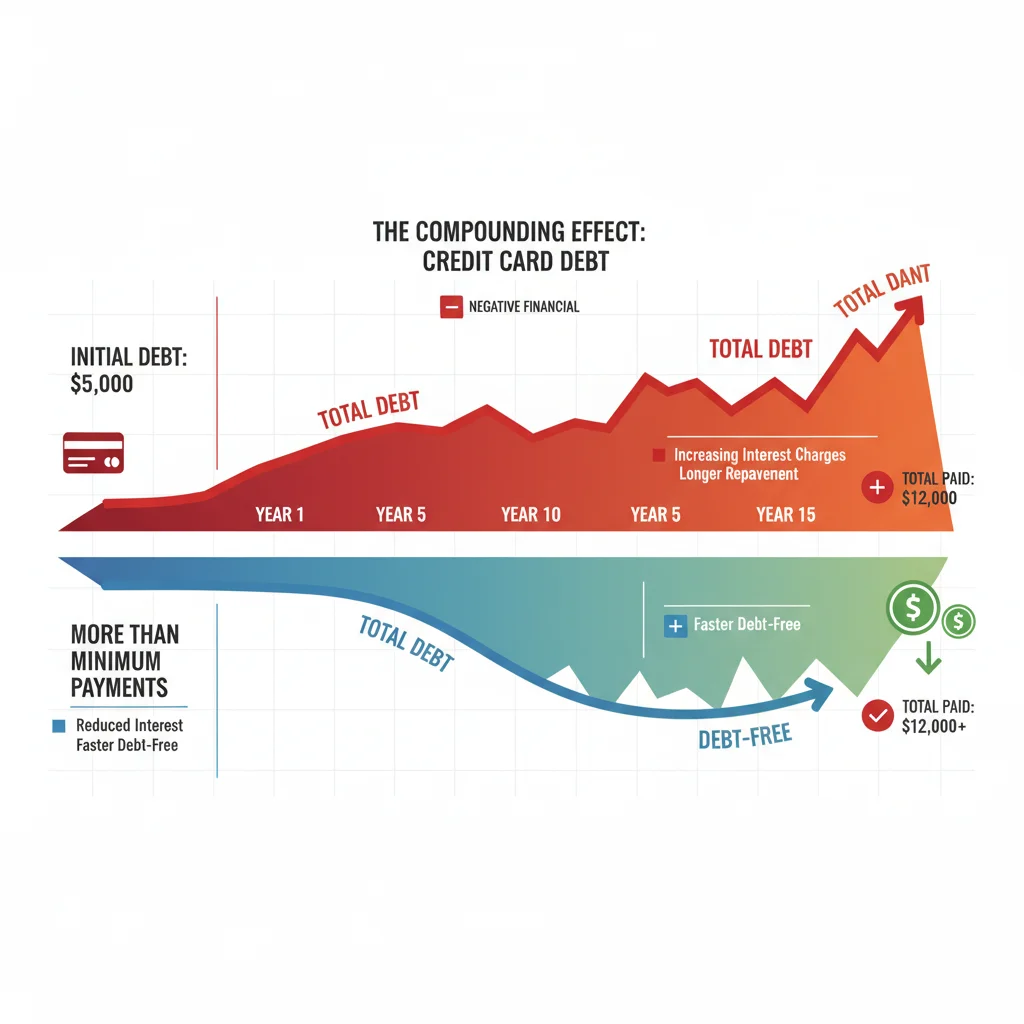

The real villain behind the high cost of minimum payments is compounding interest. This is where interest is calculated not only on the original principal but also on the accumulated interest from previous periods. When you only pay the minimum, you’re essentially allowing this compounding effect to work against you, rapidly inflating your total debt over time.

Imagine a scenario where you carry a balance of $5,000 on a credit card with an annual percentage rate (APR) of 18%. If your minimum payment is 3% of the balance, your initial minimum payment would be $150. However, a large chunk of that $150 would be swallowed by interest, perhaps leaving only a small fraction to reduce your principal. The following month, interest is calculated on a balance that has barely budged, perpetuating the cycle.

The Long-Term Impact

The long-term impact of compounding interest is staggering. What starts as a manageable debt can quickly balloon into a formidable sum. This is particularly true for high-APR cards. By solely making minimum payments, you are essentially signing up for a significantly longer repayment period, during which you will pay substantially more in interest than the original purchase price.

- Exponential Growth: Debt grows faster than anticipated.

- Higher Total Cost: You pay far more than the initial amount borrowed.

- Delayed Freedom: Takes years, sometimes decades, to clear the debt.

- Erodes Savings: Money that could be saved or invested is spent on interest.

The compounding interest trap is a silent but potent force that can erode your financial stability. Recognizing its power is the first step toward breaking free from its grip and taking control of your credit card debt.

Projecting the Cost: Thousands by 2026

To truly grasp the gravity of relying on minimum payments, let’s project the financial impact over the next few years. Consider a typical credit card scenario in 2026. Inflation and rising interest rates could mean an average APR of 20% or more. If you carry an average balance of $3,000 and consistently pay only 3% of that balance, the numbers quickly become alarming.

For example, a $3,000 balance at 20% APR with a 3% minimum payment would take over 10 years to pay off, costing you an additional $3,000-$4,000 in interest alone. This doesn’t even account for new purchases or unexpected fees. By 2026, many individuals who started with seemingly small balances could find themselves having paid thousands solely in interest, with the principal still lingering.

Real-World Scenarios

Let’s look at a hypothetical case: Sarah has a credit card balance of $4,000 with an 18% APR. Her minimum payment is 3%, which is $120. If she only pays this minimum, it would take her approximately 11 years to pay off the debt, costing her over $4,500 in interest. That’s more than the original amount she borrowed!

- Initial Balance: $4,000

- APR: 18%

- Minimum Payment (3%): $120

- Estimated Payoff Time: 11 years

- Total Interest Paid: ~$4,500

This projection highlights that by 2026, the cumulative effect of these small minimum payments will translate into substantial financial losses. These are funds that could have been used for savings, investments, or other essential expenses, instead being diverted to interest payments.

The Psychological Impact: Stress and Financial Strain

Beyond the purely financial costs, consistently making only minimum payments takes a significant psychological toll. The constant burden of debt can lead to chronic stress, anxiety, and even depression. The feeling of being trapped in a never-ending cycle, where your efforts seem to make little difference, can be incredibly demoralizing.

This financial stress can permeate other areas of your life, affecting relationships, work performance, and overall well-being. The pressure to meet minimum payments can also deter individuals from pursuing financial goals like saving for a down payment on a house, retirement, or a child’s education, creating a sense of stagnation and hopelessness.

Breaking the Cycle of Worry

Recognizing the psychological impact is crucial for motivating change. The goal isn’t just to save money, but to regain peace of mind and financial freedom. Taking proactive steps, even small ones, can significantly alleviate this burden and foster a sense of control over your finances.

- Increased Anxiety: Constant worry about debt.

- Relationship Strain: Financial stress impacts personal connections.

- Reduced Motivation: Feeling stuck in a debt cycle.

- Impact on Health: Chronic stress can lead to physical ailments.

Addressing credit card debt goes beyond numbers; it’s about improving your quality of life. The psychological relief that comes with reducing debt can be as valuable as the financial savings themselves.

Strategies to Break Free from the Minimum Payment Trap

Breaking the cycle of minimum payments requires a proactive approach and a commitment to changing financial habits. While it might seem daunting, several effective strategies can help you tackle your credit card debt more efficiently and save thousands in the long run.

Pay More Than the Minimum

This is the most straightforward and effective strategy. Even paying a little extra each month can significantly reduce your payoff time and the total interest paid. If your minimum is $50, try to pay $75 or $100. The difference, though seemingly small, can accelerate your debt repayment dramatically due to less interest accruing on a smaller principal.

Debt Snowball or Debt Avalanche Method

These are popular strategies for paying off multiple debts. The debt snowball method involves paying off the smallest debt first while making minimum payments on others. Once the smallest is paid, you roll that payment amount into the next smallest debt. The debt avalanche method focuses on paying off the debt with the highest interest rate first, which saves you the most money on interest.

- Debt Snowball: Focus on smallest debts first for psychological wins.

- Debt Avalanche: Tackle highest interest debts first for maximum savings.

- Budgeting: Create a realistic budget to find extra funds for payments.

- Consolidation: Consider balance transfer cards or personal loans at lower rates.

Implementing these strategies systematically can transform your debt repayment journey, providing a clear path to financial freedom and preventing the thousands in interest payments by 2026.

Leveraging Financial Tools and Resources

In today’s digital age, numerous financial tools and resources are available to help you manage your credit card debt more effectively. From budgeting apps to credit counseling services, these resources can provide the support and guidance needed to navigate your path to debt freedom.

Budgeting Apps and Software

Tools like Mint, YNAB (You Need A Budget), or Personal Capital can help you track your spending, identify areas where you can cut back, and allocate more funds towards debt repayment. These apps provide a clear overview of your financial situation, making it easier to stick to a plan and see your progress.

Credit Counseling Services

Non-profit credit counseling agencies offer free or low-cost advice on debt management. They can help you create a personalized budget, negotiate with creditors, and even set up a Debt Management Plan (DMP) if needed. A DMP can consolidate your payments into one manageable monthly sum, often at a reduced interest rate.

- Debt Calculators: Visualize payoff scenarios with different payment amounts.

- Financial Advisors: Professional guidance for complex financial situations.

- Balance Transfer Offers: Move high-interest debt to a card with a 0% introductory APR.

- Automated Payments: Set up automatic payments for more than the minimum to ensure consistency.

By actively using these tools and resources, you can gain a significant advantage in your fight against credit card debt. They provide the structure, insights, and support necessary to move beyond minimum payments and build a more secure financial future.

The Future of Credit Card Debt in 2026 and Beyond

Looking ahead to 2026, the landscape of credit card debt is likely to continue evolving. Economic shifts, interest rate fluctuations, and changes in consumer spending habits will all play a role. However, one constant remains: the fundamental principle that paying only the minimum will always be the most expensive way to manage credit card debt.

As financial technologies advance, we may see more personalized debt management tools and predictive analytics helping consumers understand the long-term impact of their payment choices. Regulatory changes might also influence how minimum payments are calculated, potentially making them more transparent or requiring higher percentages to accelerate debt repayment.

Preparing for Financial Resilience

Regardless of future trends, building financial resilience starts with proactive debt management today. Understanding the mechanics of interest, committing to paying more than the minimum, and utilizing available resources are timeless strategies that will protect you from the escalating costs of credit card debt. The goal isn’t just to survive financially, but to thrive.

- Stay Informed: Keep up-to-date with economic indicators and interest rates.

- Build an Emergency Fund: Reduces reliance on credit cards for unexpected expenses.

- Review Statements Regularly: Catch errors and monitor spending patterns.

- Prioritize High-Interest Debt: Always aim to tackle the most expensive debt first.

By taking these steps, you empower yourself to navigate the financial complexities of 2026 and beyond, ensuring that your credit cards work for you, rather than against you.

| Key Aspect | Impact of Minimum Payments |

|---|---|

| Total Cost | Can result in thousands of dollars in extra interest by 2026. |

| Payoff Time | Extends repayment periods for years, sometimes over a decade. |

| Interest Accumulation | Compounding interest rapidly inflates the total debt. |

| Financial Stress | Leads to significant psychological burden and limited financial progress. |

Frequently Asked Questions About Credit Card Minimum Payments

A credit card minimum payment is the lowest amount you must pay each month to keep your account in good standing. It’s usually a small percentage of your outstanding balance, plus interest and fees, and is designed to ensure the issuer recovers costs first.

It’s costly because a large portion of the minimum payment goes towards interest, leaving very little to reduce the principal balance. This allows compounding interest to continually inflate your debt, extending the repayment period and significantly increasing the total amount you pay.

To avoid the trap, always try to pay more than the minimum. Consider strategies like the debt snowball or avalanche method, create a strict budget, and explore balance transfer options or debt consolidation loans with lower interest rates.

The debt snowball method prioritizes paying off the smallest debt first for psychological wins. The debt avalanche method focuses on debts with the highest interest rates first, which saves you more money on interest over time. Both are effective debt repayment strategies.

Yes, many tools can help. Budgeting apps like Mint or YNAB track spending. Debt calculators help visualize payoff scenarios. Non-profit credit counseling services offer professional guidance and can assist with debt management plans, providing structured support.

Conclusion

The allure of making only the minimum payment on your credit card is understandable, offering immediate relief from a larger financial obligation. However, as we’ve explored, this seemingly simple choice carries a significant hidden cost. By 2026, many individuals who consistently opt for the 3% minimum could find themselves having paid thousands in interest, extending their debt repayment for years and enduring considerable financial stress. Understanding the mechanics of compounding interest, adopting proactive repayment strategies, and leveraging available financial tools are crucial steps toward breaking this cycle. Taking control of your credit card debt now is not just about saving money; it’s about securing your financial future and achieving peace of mind.