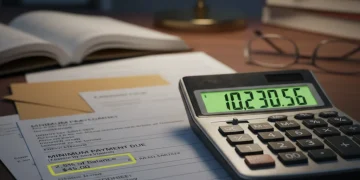

Credit Card Minimum Payments: The Hidden Cost of 3% by 2026

Paying only the minimum on your credit card can lead to significant financial strain, accumulating thousands in interest and extending debt for years. Understanding the true cost is key to effective debt management.

Maximize Credit Card Rewards 2026: 3-Month 15% Strategy

This article outlines a detailed 3-month strategy to significantly maximize credit card rewards by 15% in 2026. Discover how to strategically select cards, align spending with bonus categories, and utilize welcome offers for optimal financial gain.

New Credit Card Regulations 2026: US Consumer Guide

The new credit card regulations for 2026 are set to significantly impact US consumers, introducing changes in interest rates, fees, and consumer protections, necessitating proactive understanding and adaptation by January.

Best Business Credit Cards for Small Businesses in 2025

Navigating the 2025 landscape for business credit cards, small businesses with under $1 million in revenue can find optimal solutions offering competitive rewards, cash back, and travel perks tailored to their specific operational needs and financial growth.

2025 Credit Card Annual Fees: Waivers & Reductions for $95+ Savings

This guide explores strategies for understanding and securing 2025 annual fee waivers and reductions on premium credit cards, offering practical advice to help consumers save $95 or more.

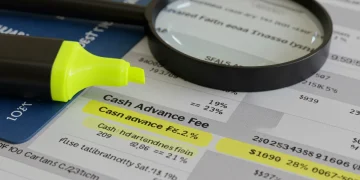

Credit Card Statements 2025: Spotting Cash Advance Fees

This guide helps you decode your 2025 credit card statement, focusing on how to identify and understand cash advance fees exceeding 2%. Equip yourself with the knowledge to protect your financial well-being.

Dispute Credit Card Charge 2025: Recover Erroneous Transactions

Effectively disputing a credit card charge in 2025 involves understanding your rights, gathering evidence, and following a structured process to recover erroneous transactions and protect your financial integrity.

Credit Card Debt Consolidation Strategies for 2025: Reduce Payments

Discover effective credit card debt consolidation strategies for 2025 designed to reduce your monthly payments by 25% or more. This guide covers various options to help you take control of your financial future.

Maximize Cashback Rewards 2025: Top 3 Rotating 5% Cards

Discover how to maximize your cashback rewards in 2025 by strategically using the top 3 credit cards that offer an impressive 5% back on rotating spending categories, optimizing your savings.