Commodity Prices 2026: 15% Energy Cost Increase Expected

Anúncios

Expert analysis suggests a potential 15% increase in energy costs, significantly impacting commodity prices in 2026 due to geopolitical shifts, supply chain disruptions, and evolving demand patterns. This rise will influence various sectors.

Anúncios

As we look towards the economic landscape of the near future, the discussion around commodity prices in 2026 takes center stage. Recent expert analysis points to a significant development: a potential 15% increase in energy costs. This projection is not just a number; it represents a profound shift that could reshape industries, influence household budgets, and redefine global economic strategies. Understanding the underlying factors and potential ripple effects of such a substantial rise is crucial for businesses, policymakers, and individual consumers alike, as we navigate an increasingly interconnected and volatile global economy.

Anúncios

Understanding the Global Energy Landscape in 2026

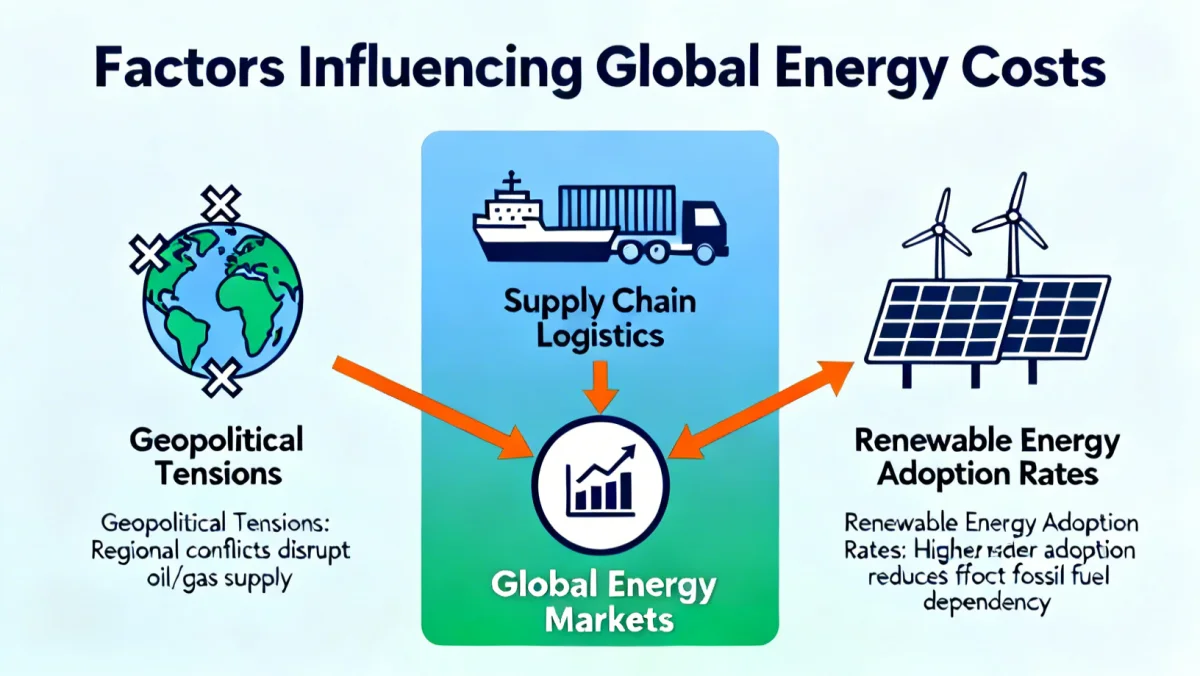

The global energy landscape in 2026 is poised for significant transformation, driven by a complex interplay of geopolitical shifts, technological advancements, and evolving environmental policies. Experts are closely monitoring these dynamics to predict the trajectory of energy costs, with many indicating a potential 15% surge. This anticipated increase is not isolated but rather a culmination of several interconnected factors that are reshaping supply and demand.

A key driver is the ongoing transition towards renewable energy sources. While this shift promises long-term sustainability, the interim period often involves substantial investment, infrastructure upgrades, and potential supply-demand imbalances for traditional energy sources. Simultaneously, geopolitical tensions in major oil-producing regions continue to introduce volatility, making stable pricing a considerable challenge. The global economy’s recovery trajectory post-pandemic, coupled with industrial growth, also plays a crucial role in dictating demand for various energy commodities.

Geopolitical Influences on Energy Prices

Geopolitical events have historically been a primary determinant of energy prices, and 2026 is unlikely to be an exception. Conflicts, trade disputes, and political instability in key energy-producing nations can disrupt supply chains, leading to immediate price hikes. The interconnectedness of global energy markets means that even localized events can have far-reaching consequences.

- Supply Chain Vulnerabilities: Disruptions in shipping routes or production facilities due to geopolitical events can create bottlenecks.

- Sanctions and Trade Policies: Economic sanctions imposed on major energy exporters can reduce global supply, driving prices up.

- Regional Conflicts: Instability in critical oil and gas regions can lead to decreased production and increased market uncertainty.

These factors contribute significantly to the unpredictability of energy costs, making it challenging for businesses and consumers to plan long-term. The 15% increase forecast for energy costs in 2026 reflects an acknowledgment of these persistent geopolitical risks.

Key Drivers Behind the Projected 15% Energy Cost Increase

The forecast of a 15% increase in energy costs for 2026 is rooted in a confluence of powerful economic, environmental, and logistical factors. Beyond immediate geopolitical concerns, several structural elements are pushing prices upwards. Understanding these drivers is essential for comprehending the broader implications for commodity prices in 2026.

One significant factor is the escalating global demand for energy, fueled by continued industrialization in emerging economies and a rebound in global travel and manufacturing. This demand surge often outpaces the immediate ability of supply to adapt, particularly for fossil fuels where new extraction projects require substantial lead times and investment. Furthermore, the increasing cost of capital for energy projects, coupled with stricter environmental regulations, adds to the production costs that are ultimately passed on to consumers.

Inflationary Pressures and Production Costs

Inflationary pressures across the global economy are not just affecting consumer goods but are also significantly impacting the energy sector. The cost of labor, materials, and transportation for energy production and distribution has risen, contributing directly to higher end-user prices. This is a cyclical effect where rising energy costs can, in turn, fuel further inflation.

- Labor Costs: Increased wages in the energy sector contribute to higher operational expenses.

- Material Prices: The cost of steel, copper, and other raw materials used in energy infrastructure has seen substantial increases.

- Transportation Logistics: Higher fuel prices for transport directly impact the cost of delivering energy commodities.

These rising production costs form a foundational layer for the projected increase, making energy more expensive to produce and deliver, irrespective of demand fluctuations. The long-term investment cycles in energy infrastructure also mean that these cost increases tend to be sticky and not easily reversible.

Impact on Various Commodity Sectors

A projected 15% increase in energy costs will not be confined to just fuel pumps or electricity bills; its ripple effects are expected to permeate across virtually all commodity sectors, profoundly influencing commodity prices in 2026. Energy is a foundational input for almost every industry, from agriculture to manufacturing and mining. When energy becomes more expensive, the cost of producing, processing, and transporting goods inevitably rises.

In agriculture, for instance, higher diesel prices impact farming machinery, irrigation systems, and fertilizer production, leading to increased food prices. For industrial metals, the energy-intensive processes of extraction and refining will see their costs surge, translating into higher prices for commodities like steel, aluminum, and copper. Even soft commodities and precious metals will feel the indirect effects through increased transportation costs and broader inflationary pressures.

Agriculture and Food Prices

The agricultural sector is particularly vulnerable to rising energy costs. Modern farming relies heavily on energy for various stages of production, from planting to harvesting and distribution. A significant increase in energy expenses directly translates to higher operational costs for farmers.

- Fertilizer Production: Natural gas is a key input for nitrogen-based fertilizers; higher gas prices mean more expensive fertilizers.

- Farm Machinery: Diesel fuel powers tractors and other heavy machinery, so increased fuel costs raise cultivation expenses.

- Transportation: Moving produce from farms to markets requires fuel, making logistics more expensive.

These combined factors suggest that consumers could face higher food prices, adding another layer of inflationary pressure to household budgets. The increase in energy costs could thus have a direct and visible impact on everyday living expenses.

Economic Implications for Businesses and Consumers

The projected 15% increase in energy costs for 2026 carries significant economic implications for both businesses and consumers, extending far beyond the immediate impact on energy bills. For businesses, higher energy expenses will squeeze profit margins, forcing companies to either absorb the costs, innovate for efficiency, or pass them on to consumers through higher prices. This could lead to a slowdown in economic growth, as consumer spending power diminishes and business investment becomes more cautious.

Consumers will likely face a double whammy: direct increases in their utility bills and fuel costs, coupled with indirect price hikes on a wide array of goods and services. This erosion of purchasing power could lead to shifts in consumption patterns, with households prioritizing essential spending and cutting back on discretionary items. The overall effect on commodity prices in 2026 will manifest as a general upward trend, making careful financial planning even more critical.

Business Adaptations and Strategies

Businesses will need to implement strategic adaptations to mitigate the impact of rising energy costs. This could involve significant shifts in operational models and supply chain management. Companies that can quickly pivot to more energy-efficient practices or invest in renewable energy solutions may gain a competitive advantage.

- Energy Efficiency Investments: Upgrading machinery and facilities to consume less energy.

- Supply Chain Optimization: Re-evaluating logistics to reduce transportation costs and sourcing materials closer to production.

- Pricing Adjustments: Carefully managing price increases to remain competitive while covering rising input costs.

These strategic responses will be crucial for businesses to maintain profitability and stability in an environment of escalating energy expenses. The ability to adapt quickly will differentiate resilient companies from those that struggle to cope.

Government and Policy Responses to Rising Costs

In anticipation of a potential 15% increase in energy costs and its broader impact on commodity prices in 2026, governments worldwide are likely to implement various policy responses. These interventions will aim to mitigate the economic burden on citizens and businesses, while also steering economies towards more sustainable and resilient energy futures. The challenge for policymakers will be to balance immediate relief measures with long-term strategic goals.

Potential government actions could include subsidies for energy-efficient technologies, tax breaks for industries heavily impacted by rising costs, or direct financial aid for low-income households. Moreover, there will be increased pressure to accelerate investments in renewable energy infrastructure and energy storage solutions to reduce reliance on volatile fossil fuel markets. International cooperation on energy security and trade policies will also play a crucial role in stabilizing global energy markets.

Policy Levers for Mitigation

Governments have several policy levers at their disposal to address rising energy costs and their ripple effects. The effectiveness of these policies will depend on their timely implementation and coordination across different sectors.

- Strategic Petroleum Reserves: Releasing reserves to temporarily increase supply and stabilize prices.

- Renewable Energy Incentives: Offering tax credits or grants for solar, wind, and other clean energy installations.

- Consumer Subsidies: Direct financial assistance or rebates to help households cope with higher energy bills.

These policy measures are designed to cushion the blow of increased energy costs, ensuring economic stability and protecting vulnerable populations from disproportionate impacts. However, their long-term efficacy will depend on addressing the root causes of energy price volatility.

Investment Opportunities and Risks Amidst Rising Commodity Prices

The projected 15% increase in energy costs and the broader impact on commodity prices in 2026 present both significant investment opportunities and considerable risks. For savvy investors, understanding these dynamics can unlock potential gains, while neglecting them could lead to substantial losses. The changing landscape necessitates a re-evaluation of portfolio strategies, with a focus on resilience and adaptability.

Sectors poised to benefit include renewable energy companies, energy efficiency solution providers, and certain segments of the mining industry that produce critical minerals for green technologies. Conversely, industries heavily reliant on traditional energy sources, or those with thin margins in energy-intensive processes, might face headwinds. Investors will need to conduct thorough due diligence, considering both the direct and indirect impacts of rising energy costs on various assets.

Emerging Sectors and Defensive Plays

As energy costs rise, certain sectors become more attractive, while others require a defensive investment approach. Identifying these shifts early can provide a competitive edge in investment decisions.

- Renewable Energy: Companies in solar, wind, and battery storage are likely to see increased demand and investment.

- Energy Efficiency: Businesses offering solutions for reducing energy consumption across industries.

- Utilities: Regulated utilities might offer defensive stability, though their profitability can be impacted by input costs.

Investors should consider diversifying their portfolios to include assets that are either insulated from or benefit from higher energy prices. This strategic allocation can help mitigate risks and capture potential growth opportunities in a shifting economic environment.

Future Outlook and Long-Term Trends

Looking beyond the immediate forecast of a 15% increase in energy costs for 2026, the long-term outlook for commodity prices in 2026 and beyond suggests a continued evolution driven by sustainability goals, technological advancements, and shifting global power dynamics. While short-term volatility is anticipated, the overarching trend points towards a more diversified and, hopefully, more resilient energy mix.

The push for decarbonization will intensify, leading to greater investment in clean energy technologies and a gradual reduction in reliance on fossil fuels. However, the transition will not be without its challenges, including the need for massive infrastructure upgrades, secure supply chains for critical minerals, and robust energy storage solutions. Geopolitical factors will continue to play a role, but the emphasis may shift towards securing resources for the green economy rather than just oil and gas.

Technological Innovations and Market Dynamics

Technological innovation will be a crucial determinant of future energy costs. Breakthroughs in energy generation, storage, and consumption efficiency can significantly alter market dynamics and reduce long-term price pressures. Smart grids, advanced battery technologies, and new forms of renewable energy are all part of this transformative wave.

- Advanced Storage Solutions: Innovations in battery technology can smooth out the intermittency of renewable energy.

- Carbon Capture Technologies: Efforts to mitigate emissions from traditional energy sources could become more widespread.

- Hydrogen Economy: Development of green hydrogen production could offer a clean alternative for various industrial and transport applications.

These technological advancements, coupled with evolving market structures, will shape the long-term trajectory of energy and commodity prices. The future will likely be characterized by a dynamic interplay of traditional and new energy sources, with a growing emphasis on sustainability and resilience.

| Key Point | Brief Description |

|---|---|

| Energy Cost Increase | Experts project a 15% rise in energy costs by 2026, impacting global economies. |

| Driving Factors | Geopolitical tensions, rising global demand, and inflationary pressures are key contributors. |

| Economic Impact | Businesses face higher operational costs, while consumers see increased prices for goods and services. |

| Policy Responses | Governments may implement subsidies, incentives, and strategic reserves to mitigate impacts. |

Frequently Asked Questions About 2026 Commodity Prices

The main drivers include persistent geopolitical instability, a sustained rise in global energy demand, and widespread inflationary pressures affecting production and transportation costs across the energy sector. Supply chain vulnerabilities also contribute significantly.

Households can expect higher utility bills and increased fuel expenses for transportation. Additionally, the cost of goods and services will likely rise due to increased production and distribution costs for businesses, impacting overall purchasing power.

Energy-intensive sectors such as agriculture, manufacturing, and mining are particularly vulnerable. Higher energy costs directly impact fertilizer production, industrial processing, and transportation logistics, leading to increased prices for their outputs.

Businesses can invest in energy-efficient technologies, optimize supply chains to reduce transportation needs, explore renewable energy sources, and carefully manage pricing strategies. Adapting quickly to these changes will be crucial for maintaining profitability and competitiveness.

Long-term trends towards decarbonization and increased investment in renewable energy could eventually offset some increases. However, the transition period might see continued volatility. Technological breakthroughs in energy storage and efficiency could also play a significant mitigating role.

Conclusion

The expert analysis forecasting a potential 15% increase in energy costs by 2026 underscores a critical juncture for the global economy. This rise, driven by a complex mix of geopolitical tensions, demand-side pressures, and inflationary trends, will inevitably reshape commodity prices in 2026 across various sectors. While the challenges for businesses and consumers are evident, strategic planning, technological innovation, and proactive policy responses can help mitigate the adverse effects. The coming years will demand adaptability and foresight from all stakeholders to navigate a dynamic and evolving energy landscape, fostering resilience and steering towards a more sustainable economic future.