Financial Goal Setting 2025: Achieve Your Objectives

Anúncios

Effectively achieving financial objectives in 2025 requires a structured educational framework that guides individuals through defining, planning, and executing personalized strategies for sustainable wealth growth and financial security.

Anúncios

As we look towards the horizon of 2025, the concept of financial goal setting 2025 emerges as a cornerstone for personal and economic stability. Are you prepared to transform your financial aspirations into tangible achievements?

Anúncios

Understanding the Importance of Financial Goal Setting

Embarking on a journey without a map often leads to getting lost. The same principle applies to your finances. Without clearly defined goals, your financial decisions can become reactive rather than strategic, making it difficult to build wealth or achieve long-term security. Understanding the profound importance of setting financial goals is the first step towards a more prosperous future.

Financial goals provide direction and purpose for your money. They help you prioritize spending, saving, and investing, ensuring that every dollar has a job and is working towards your objectives. This proactive approach can alleviate financial stress and empower you to make informed choices that align with your deepest aspirations, whether it’s buying a home, funding retirement, or starting a business.

Why 2025 is a Critical Year for Financial Planning

The economic landscape is constantly evolving, presenting both challenges and opportunities. 2025, like any year, brings its own set of unique circumstances that necessitate thoughtful financial planning. Proactive goal setting allows you to adapt to potential market shifts, inflation, or personal life changes, transforming potential obstacles into stepping stones.

- Economic Volatility: Preparing for potential economic fluctuations with a clear financial plan.

- Personal Milestones: Aligning financial goals with life events like marriage, children, or career changes.

- Technological Advancements: Leveraging new financial tools and platforms to optimize savings and investments.

Moreover, setting goals for a specific year like 2025 creates a clear deadline, injecting a sense of urgency and accountability into your financial endeavors. This focused timeline can motivate consistent action and prevent procrastination, which are common pitfalls in personal finance.

In essence, recognizing the critical role of financial goal setting is about taking control of your financial destiny. It’s about moving from simply managing money to strategically orchestrating its growth and deployment in a way that serves your life’s vision. This foundational understanding sets the stage for building a robust educational framework.

Establishing Your Educational Framework for Financial Success

An effective educational framework for financial goal setting is not merely about listing desired outcomes; it involves a systematic approach to learning, planning, and execution. This framework empowers you with the knowledge and tools necessary to navigate the complexities of personal finance and make intelligent decisions.

The core of this framework lies in continuous education. Financial markets, products, and regulations are constantly changing. Staying informed and understanding these shifts is crucial for adapting your strategies and optimizing your financial health. This educational journey should be personalized, focusing on areas most relevant to your individual goals and circumstances.

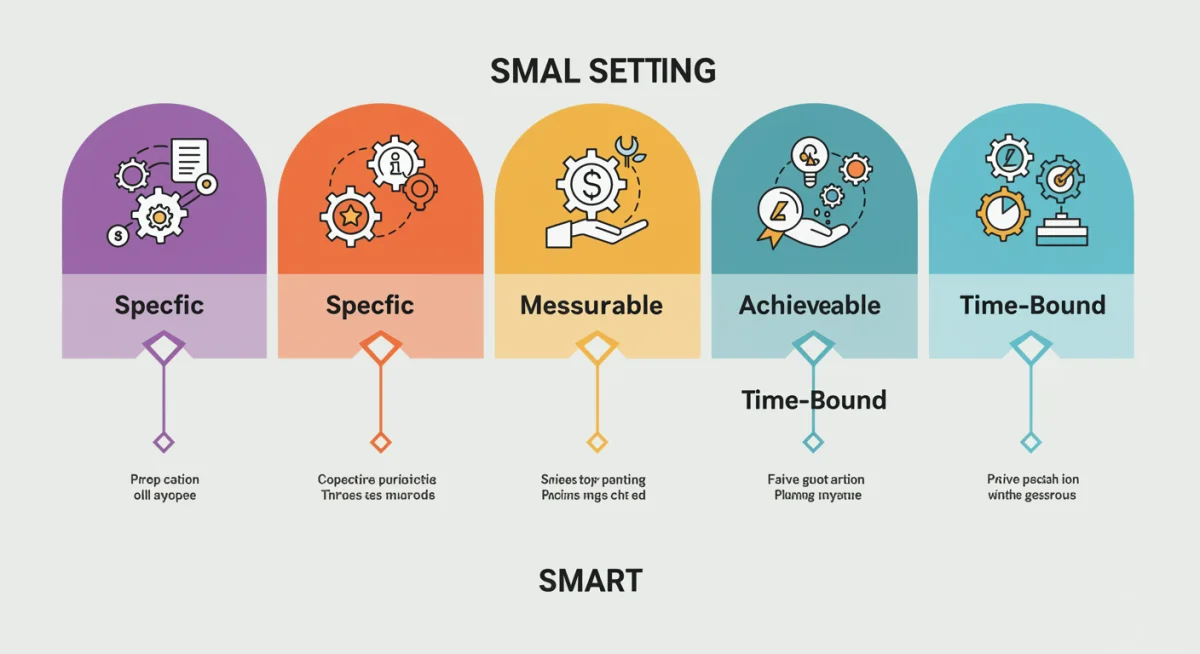

Defining SMART Financial Goals

The acronym SMART provides a powerful guide for creating goals that are not only ambitious but also attainable. Applying the SMART criteria to your financial objectives ensures clarity, measurability, and a realistic path to achievement.

- Specific: Clearly articulate what you want to achieve. Instead of ‘save money,’ aim for ‘save $10,000 for a down payment.’

- Measurable: Your goal should have quantifiable metrics. How will you know when you’ve reached it?

- Achievable: Is the goal realistic given your current financial situation and resources?

- Relevant: Does this goal align with your broader life values and long-term aspirations?

- Time-bound: Set a clear deadline for when you intend to achieve the goal, such as ‘by December 31, 2025.’

By meticulously applying the SMART framework, you transform vague desires into concrete objectives. This process forces you to think critically about the steps required, the resources needed, and the timeline involved, making your goals far more likely to be realized. It’s a fundamental pillar of effective financial goal setting 2025.

Ultimately, establishing a robust educational framework means committing to lifelong learning in finance. It’s about not just setting goals, but also understanding the ‘how’ and ‘why’ behind them, continuously refining your knowledge and strategies as you progress.

Assessing Your Current Financial Landscape

Before charting a course for 2025, it’s imperative to understand your current financial position. This involves a thorough and honest assessment of your income, expenses, assets, and liabilities. Without this baseline knowledge, any goal-setting effort will be built on shaky ground, potentially leading to unrealistic expectations or missed opportunities.

Think of it as a financial health check-up. Just as a doctor needs to know your current health status before prescribing a treatment plan, you need to understand your financial health before setting new goals. This assessment provides the critical data points required for informed decision-making.

Calculating Your Net Worth

Your net worth is a snapshot of your financial health at a specific point in time. It’s calculated by subtracting your total liabilities (what you owe) from your total assets (what you own). This single figure can be incredibly illuminating, providing a clear indication of your financial progress over time.

- Assets: Include cash, savings accounts, investments (stocks, bonds, mutual funds), real estate, vehicles, and other valuable possessions.

- Liabilities: Include credit card debt, student loans, mortgages, car loans, and any other outstanding debts.

Regularly calculating your net worth, perhaps quarterly or annually, allows you to track your progress towards your financial goals. A rising net worth indicates that you are accumulating wealth, while a stagnant or falling net worth might signal a need to adjust your financial strategies.

Analyzing Income and Expenses

Understanding where your money comes from and where it goes is fundamental to effective financial management. This involves creating a detailed budget that tracks all your income sources and categorizes your expenditures. Many people are surprised to discover how much they spend on non-essential items once they meticulously track their outflow.

An income and expense analysis helps identify areas where you can save more, redirect funds towards your goals, or even explore opportunities to increase your income. This awareness is a powerful tool for optimizing your financial resources and ensuring they are aligned with your financial goal setting 2025 objectives.

By diligently assessing your current financial landscape, you gain clarity and control. This foundational step provides the necessary data to set realistic, achievable goals and to monitor your progress effectively throughout 2025 and beyond.

Developing Your Personalized Financial Strategy

Once your goals are clearly defined and your current financial situation is assessed, the next crucial step is to develop a personalized financial strategy. This strategy acts as your roadmap, detailing the specific actions you will take to move from your current state to your desired financial future. It’s about translating abstract goals into actionable steps.

A personalized strategy considers your unique risk tolerance, time horizon, and life circumstances. There’s no one-size-fits-all solution in personal finance; what works for one person might not work for another. The effectiveness of your strategy hinges on its tailor-made nature.

Budgeting for Success

A well-crafted budget is the cornerstone of any successful financial strategy. It’s not about restriction, but about intentional spending and saving. A budget helps you allocate your income efficiently, ensuring that you have enough for essential expenses, debt repayment, savings, and investments.

Modern budgeting tools, from apps to spreadsheets, can simplify this process. The key is to find a method that you can consistently stick to. Regular review and adjustment of your budget are also essential, as your income and expenses may change over time.

Strategic Saving and Investing

Saving and investing are two distinct but complementary components of wealth building. Saving typically involves setting aside money for short-term goals or emergencies, often in easily accessible accounts. Investing, on the other hand, is about putting your money to work for long-term growth, usually for goals several years or decades away.

- Emergency Fund: Prioritize building an emergency fund covering 3-6 months of living expenses.

- Retirement Accounts: Maximize contributions to 401(k)s, IRAs, and other tax-advantaged retirement vehicles.

- Diversified Investments: Explore a diversified portfolio that aligns with your risk tolerance, including stocks, bonds, and mutual funds.

For your financial goal setting 2025, consider how your savings and investment strategies align with your specific objectives. For instance, if your goal is a down payment on a house in two years, you might opt for lower-risk savings vehicles compared to long-term retirement investments.

Developing a personalized financial strategy is an ongoing process of refinement and adaptation. It requires discipline, patience, and a willingness to learn, but the rewards of achieving your financial aspirations are immeasurable.

Leveraging Tools and Resources for Goal Achievement

In today’s digital age, a plethora of tools and resources are available to assist with financial goal setting and achievement. Leveraging these effectively can significantly streamline your financial management process, providing insights, automation, and expert guidance. The right tools can transform daunting tasks into manageable steps, making your journey to financial success smoother.

From budgeting apps that track every penny to investment platforms offering automated portfolios, technology has democratized access to sophisticated financial planning. The challenge lies in identifying which tools best suit your individual needs and goals for 2025.

Utilizing Budgeting and Tracking Apps

Modern budgeting applications offer much more than just expense tracking. Many provide comprehensive financial dashboards, categorize spending automatically, and even offer insights into your spending habits. Apps like Mint, YNAB (You Need A Budget), and Personal Capital can connect to your bank accounts, credit cards, and investment portfolios, providing a holistic view of your finances.

- Automated Expense Categorization: Saves time and provides clear insights into spending patterns.

- Goal Tracking Features: Monitor progress towards specific savings or debt repayment goals.

- Net Worth Tracking: See your assets and liabilities updated in real-time.

These tools are invaluable for maintaining accountability and ensuring you stay on track with your financial goal setting 2025. They remove much of the manual effort traditionally associated with budgeting, allowing you to focus on strategic decisions.

Exploring Investment Platforms and Financial Advisors

For those looking to invest or requiring more complex financial planning, online investment platforms and professional financial advisors can be indispensable resources. Robo-advisors, such as Betterment and Wealthfront, offer automated, diversified portfolios tailored to your risk tolerance and goals at a lower cost than traditional advisors.

For more personalized guidance, especially for complex situations like estate planning, tax optimization, or significant wealth management, a certified financial planner (CFP) can provide expert advice. They can help you craft a long-term investment strategy, understand tax implications, and navigate various financial instruments.

By intelligently integrating these tools and resources into your financial routine, you can enhance your ability to manage your money effectively, make informed decisions, and ultimately achieve your financial objectives for 2025 and beyond.

Monitoring Progress and Adapting Your Plan

Setting financial goals and creating a strategy are significant achievements, but the journey doesn’t end there. Continuous monitoring and periodic adaptation of your plan are crucial for sustained success. Life is dynamic, and your financial plan must be flexible enough to evolve with your changing circumstances, market conditions, and personal goals. This iterative process ensures that your financial goal setting 2025 remains relevant and effective.

Without regular check-ups, even the most meticulously crafted plan can veer off course. Monitoring allows you to identify deviations early, understand their causes, and make necessary adjustments before they become significant roadblocks.

Regular Financial Reviews

Schedule dedicated times to review your financial situation. This could be monthly, quarterly, or annually, depending on the complexity of your goals and your personal preference. During these reviews, assess your progress against each goal, analyze your budget performance, and check your investment portfolio’s health.

- Budget vs. Actual Spending: Compare your planned spending with your actual expenditures to identify discrepancies.

- Goal Progress: Track how close you are to reaching each specific financial goal.

- Investment Performance: Review your portfolio’s returns and ensure it aligns with your risk tolerance and objectives.

These reviews are not meant to be punitive but rather educational opportunities to learn from your financial habits and make informed decisions moving forward. They reinforce the discipline required for long-term financial health.

Adjusting Your Strategy as Needed

Financial planning is not a set-it-and-forget-it endeavor. Life events such as a new job, marriage, children, unexpected expenses, or changes in the economic climate will necessitate adjustments to your financial strategy. Being flexible and willing to adapt is a hallmark of successful financial management.

For instance, if you receive a raise, you might adjust your savings rate or increase contributions to your investment accounts. Conversely, if you face an unexpected expense, you might temporarily reduce discretionary spending or re-prioritize certain goals. The key is to remain proactive and make conscious decisions rather than letting circumstances dictate your financial future.

Ultimately, monitoring progress and adapting your plan ensures that your financial roadmap remains current and effective. It’s an ongoing commitment to your financial well-being, paving the way for the successful achievement of your 2025 financial objectives and beyond.

Cultivating a Mindset for Financial Discipline and Resilience

Achieving significant financial goals, especially those set for a target year like 2025, requires more than just a well-structured plan; it demands a strong mindset rooted in discipline and resilience. The path to financial success will inevitably have its challenges, setbacks, and temptations. Cultivating the right mental approach is paramount to navigating these obstacles and staying committed to your objectives.

Financial discipline is about making consistent, conscious choices that align with your long-term goals, even when immediate gratification seems more appealing. Resilience is the ability to bounce back from financial setbacks, learn from mistakes, and continue moving forward.

Overcoming Financial Obstacles

No financial journey is perfectly smooth. You might encounter unexpected expenses, a job loss, market downturns, or simply periods where motivation wanes. How you respond to these challenges largely determines your ultimate success. Instead of viewing obstacles as failures, see them as opportunities for learning and adjustment.

- Build an Emergency Fund: A robust emergency fund acts as a safety net, reducing the impact of unexpected financial shocks.

- Educate Yourself: Continuous learning about personal finance equips you with the knowledge to make better decisions during challenging times.

- Seek Support: Discussing challenges with a trusted partner, friend, or financial advisor can provide new perspectives and encouragement.

Developing problem-solving skills and a proactive approach to potential issues are crucial components of financial resilience. It’s about anticipating difficulties and having strategies in place to address them, ensuring your financial goal setting 2025 remains on track.

Maintaining Motivation and Consistency

Long-term financial goals can sometimes feel distant, making it hard to stay motivated. Breaking down large goals into smaller, more manageable milestones can help maintain momentum. Celebrate small victories along the way to reinforce positive financial behaviors.

Consistency is perhaps the most powerful driver of financial success. Small, consistent actions over time—like regularly contributing to savings, sticking to your budget, and making wise investment choices—compound into significant progress. Automating savings and investments can be an effective way to enforce consistency, removing the need for daily decisions.

By fostering a mindset of discipline and resilience, you empower yourself to not only set ambitious financial goals but also to confidently overcome any challenges that arise. This mental fortitude is a critical, often overlooked, asset in your journey towards financial freedom and achieving your 2025 objectives.

The Long-Term Impact of Effective Financial Goal Setting

While the focus on financial goal setting 2025 provides an immediate roadmap, the true power of this practice lies in its long-term impact. Establishing and diligently pursuing financial goals transforms more than just your bank account; it fundamentally alters your relationship with money, cultivates invaluable habits, and lays a robust foundation for enduring financial well-being. This ripple effect extends far beyond a single calendar year.

Effective financial goal setting is not a one-time event but rather a continuous process that builds momentum over time. Each goal achieved, each financial milestone reached, reinforces positive behaviors and builds confidence, making future financial endeavors more attainable and less daunting.

Building Sustainable Wealth and Security

The consistent application of goal-setting principles leads directly to the accumulation of sustainable wealth. By systematically saving, investing, and managing debt, you create a financial buffer that provides security against unexpected events and opens doors to new opportunities. This proactive approach ensures that your financial future is not left to chance but is actively shaped by your deliberate actions.

- Compounding Returns: Early and consistent investing allows your money to grow exponentially over time.

- Reduced Financial Stress: A clear plan and growing reserves significantly reduce anxiety about money.

- Increased Opportunities: Financial stability provides the freedom to pursue career changes, travel, or entrepreneurial ventures.

The security derived from a well-managed financial life allows for greater peace of mind and the ability to focus on other important aspects of life, such as relationships, health, and personal growth. It’s about building a life by design, not by default.

Creating a Legacy and Future Opportunities

Beyond personal security, effective financial goal setting can also enable you to create a lasting legacy. Whether it’s funding your children’s education, contributing to philanthropic causes, or leaving an inheritance, your financial planning today can have a profound impact on future generations and the causes you care about.

Moreover, a strong financial foundation provides the flexibility to seize unexpected opportunities. This could be anything from a unique investment opening to the chance to retire earlier than planned. By being prepared, you are positioned to make the most of life’s unpredictable moments.

In conclusion, the long-term impact of effective financial goal setting extends far beyond the immediate objectives of 2025. It’s about cultivating a financially intelligent lifestyle that fosters continuous growth, security, and the freedom to live life on your own terms for decades to come.

| Key Aspect | Brief Description |

|---|---|

| SMART Goals | Specific, Measurable, Achievable, Relevant, Time-bound objectives for clarity and attainability. |

| Financial Assessment | Understanding current net worth, income, and expenses to establish a financial baseline. |

| Strategic Planning | Developing personalized budgets, saving, and investment strategies. |

| Monitoring & Adaptation | Regularly reviewing progress and adjusting plans in response to life changes or market shifts. |

Frequently Asked Questions About Financial Goal Setting

The initial step is to assess your current financial situation thoroughly. This involves calculating your net worth, analyzing your income and expenses, and understanding your existing debt. This baseline knowledge is crucial for setting realistic and achievable goals for the upcoming year.

To make your goals SMART, ensure they are Specific (clear), Measurable (quantifiable), Achievable (realistic), Relevant (aligned with values), and Time-bound (with a deadline). For example, instead of ‘save more,’ aim for ‘save $5,000 for a vacation by December 2025.’

Budgeting is fundamental. It allows you to track where your money goes, identify areas for savings, and intentionally allocate funds towards your goals. A well-managed budget ensures your spending aligns with your objectives and helps prevent financial drift, keeping you on track for 2025.

It is advisable to review your financial goals and strategy at least quarterly. This allows you to monitor progress, identify any necessary adjustments due to life changes or market shifts, and maintain motivation. Annual comprehensive reviews are also crucial for long-term planning.

Setbacks are a normal part of any financial journey. It’s important to remain resilient, learn from the experience, and adjust your plan as needed. Re-evaluate your budget, seek advice, and remember that consistent, small steps can still lead to significant progress over time.

Conclusion

The journey of financial goal setting 2025 is a powerful testament to the impact of intentional planning and disciplined execution. By embracing an educational framework that emphasizes clear goal definition, thorough financial assessment, strategic planning, and continuous adaptation, individuals can transform their financial aspirations into concrete realities. This comprehensive approach not only provides a roadmap for achieving specific monetary objectives within the year but also cultivates a resilient mindset and fosters sustainable wealth creation for decades to come. The effort invested in understanding and applying these principles today will undoubtedly yield profound and lasting benefits, securing a more prosperous and fulfilling financial future.