Mastering 2026 US Tax Code: Boost Savings 15% with Education

Anúncios

Mastering the 2026 U.S. Tax Code is crucial for optimizing financial health, enabling individuals and businesses to leverage new regulations for a significant savings boost through strategic financial education.

Anúncios

As the financial landscape continually evolves, understanding and adapting to new tax regulations becomes paramount for individuals and businesses alike. The upcoming changes in the 2026 U.S. Tax Code present a unique opportunity to significantly enhance your financial position, potentially boosting your savings by up to 15% through informed financial education and strategic planning.

Anúncios

Understanding the Core Changes in the 2026 U.S. Tax Code

The 2026 U.S. Tax Code introduces several key modifications that will impact various aspects of personal and business finance. These changes are not merely administrative adjustments; they represent a shift in how taxes are calculated, deductions are claimed, and investments are treated. A proactive approach to understanding these core changes is essential for effective financial planning.

One of the primary areas of focus for the 2026 code is the expiration of certain provisions from the Tax Cuts and Jobs Act (TCJA) of 2017. This means that many individual income tax rates are set to revert to their pre-TCJA levels, and the standard deduction amounts may also see adjustments. For many taxpayers, this could translate to higher tax liabilities if not properly anticipated and addressed through strategic adjustments to their financial practices. Understanding the nuances of these expirations is the first step toward mitigating potential negative impacts and identifying new opportunities.

Key Expirations and Adjustments

The sunsetting of TCJA provisions will bring about several notable changes that require attention. It’s not just about higher tax brackets; it also involves personal exemptions, which are set to return, and the child tax credit, which may revert to its original structure. These elements collectively shape a taxpayer’s overall liability.

- Individual Income Tax Rates: Expect changes in the marginal tax rates, potentially affecting how much of your income is subject to higher taxation.

- Standard Deduction Amounts: The generous standard deduction amounts introduced by TCJA are scheduled to decrease, making itemizing deductions more appealing for some.

- Personal Exemptions: The return of personal exemptions could offer a new avenue for reducing taxable income, especially for larger families.

- Child Tax Credit: Changes to the child tax credit’s value and eligibility requirements will be significant for families with children.

Beyond individual tax rates, the 2026 code may also feature modifications to capital gains taxes and estate taxes. While specific details are still emerging, staying informed about these potential shifts is crucial for investors and those with substantial assets. The impact on investment strategies and estate planning could be profound, necessitating a review of current holdings and future transfer plans. Ultimately, comprehending these fundamental changes provides the groundwork for developing a robust financial education strategy tailored to the new tax environment.

Optimizing Financial Education for Tax Efficiency

Effective financial education is the cornerstone of successful tax optimization under the 2026 U.S. Tax Code. It’s not enough to simply be aware of the changes; individuals and businesses must actively learn how to apply this knowledge to their specific financial situations. This involves understanding tax-advantaged accounts, leveraging deductions and credits, and making informed investment decisions.

A comprehensive financial education strategy should focus on practical application. This means moving beyond theoretical knowledge to hands-on planning and execution. For instance, knowing that tax brackets are changing is one thing; understanding how to adjust your withholding or estimated tax payments to avoid surprises is another. The goal is to empower taxpayers to make proactive choices that minimize their tax burden legally and ethically.

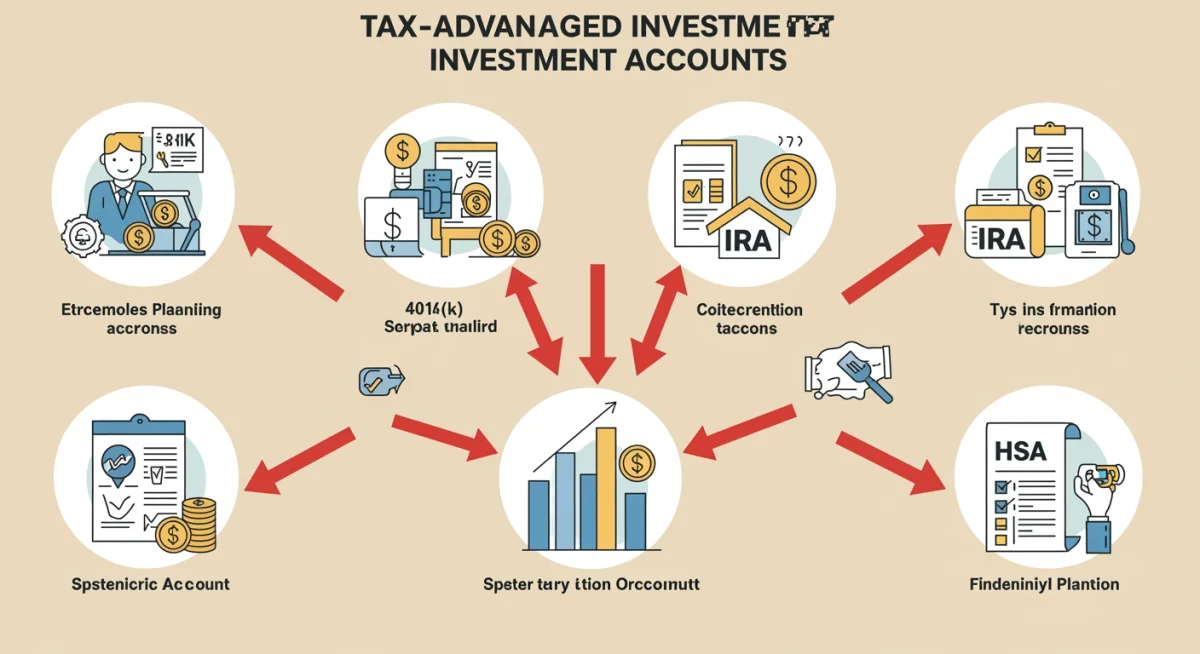

Leveraging Tax-Advantaged Accounts

One of the most effective ways to reduce taxable income and grow wealth is through strategic use of tax-advantaged accounts. These vehicles offer various benefits, from tax-deferred growth to tax-free withdrawals, depending on the account type. Maximizing contributions to these accounts should be a key component of any financial education plan aimed at tax efficiency.

- 401(k) and 403(b) Plans: Employer-sponsored retirement plans allow pre-tax contributions, reducing current taxable income, and offer tax-deferred growth.

- Individual Retirement Accounts (IRAs): Traditional IRAs offer similar tax benefits, while Roth IRAs provide tax-free withdrawals in retirement, making them excellent tools for long-term savings.

- Health Savings Accounts (HSAs): HSAs offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- 529 Plans: These education savings plans offer tax-free growth and withdrawals for qualified education expenses, providing a significant benefit for families.

Understanding the contribution limits, eligibility requirements, and withdrawal rules for each of these accounts is vital. Financial education should equip individuals with the ability to choose the accounts that best fit their financial goals and risk tolerance. Moreover, it should emphasize the importance of consistent contributions and long-term planning to fully capitalize on these tax benefits.

Strategic Tax Planning for a 15% Savings Boost

Achieving a 15% savings boost requires more than just passive knowledge of the tax code; it demands strategic tax planning. This involves a deliberate and ongoing process of evaluating your financial situation, identifying opportunities for tax reduction, and implementing proactive measures. The 2026 U.S. Tax Code provides a new framework within which these strategies must be developed and executed.

Strategic tax planning encompasses a variety of techniques, from optimizing deductions and credits to structuring investments and business operations in a tax-efficient manner. It often requires collaboration with financial advisors and tax professionals who can offer tailored guidance based on your unique circumstances. The goal is to minimize your overall tax liability while remaining compliant with all regulations.

Maximizing Deductions and Credits

With the potential changes to standard deduction amounts, thoroughly understanding and maximizing eligible deductions and credits will be more important than ever. Financial education should highlight common deductions and credits, as well as less-known opportunities that could significantly reduce taxable income.

- Itemized Deductions: For those whose itemized deductions exceed the new standard deduction, understanding categories like mortgage interest, state and local taxes (SALT), medical expenses, and charitable contributions is key.

- Tax Credits: Credits directly reduce your tax liability dollar-for-dollar. Explore credits for education, energy-efficient home improvements, dependent care, and retirement savings contributions (Saver’s Credit).

- Business Deductions: Small business owners should be aware of all eligible business expenses, depreciation, and qualified business income (QBI) deductions, which may see adjustments.

Effective tax planning also involves timing income and expenses. For example, accelerating deductions into a higher-income year or deferring income into a lower-income year can create significant tax savings. This proactive management of financial transactions, guided by an understanding of future tax implications, is a hallmark of strategic tax planning. By meticulously reviewing all available options, taxpayers can significantly reduce their tax burden and realize substantial savings.

Impact on Investments and Retirement Planning

The 2026 U.S. Tax Code will inevitably influence investment and retirement planning strategies. Changes in capital gains rates, dividend taxation, and retirement account rules can alter the attractiveness of various investment vehicles and the optimal timing for withdrawals. A thorough financial education must address these impacts to ensure long-term financial security.

Investors need to reassess their portfolios in light of potential tax changes. What was once a tax-efficient strategy may become less so, and new opportunities might emerge. This requires a dynamic approach to investment management, constantly evaluating how tax laws interact with market conditions and personal financial goals. Retirement planning, in particular, demands careful consideration, as tax implications can significantly affect the net income available during retirement years.

Adjusting Investment Strategies

With potential shifts in capital gains taxes and other investment-related regulations, investors should consider adjustments to their portfolios. This might include rebalancing assets, exploring tax-loss harvesting opportunities, or shifting towards more tax-efficient investments.

- Capital Gains: Monitor potential changes to short-term and long-term capital gains rates, which could influence decisions on when to sell appreciated assets.

- Dividend Income: Understand how qualified dividends might be taxed under the new code, impacting investments in dividend-paying stocks.

- Tax-Efficient Funds: Consider municipal bonds, which often offer tax-exempt interest, or exchange-traded funds (ETFs) that can be more tax-efficient than actively managed mutual funds.

For retirement planning, the 2026 tax code could influence decisions regarding Roth conversions, required minimum distributions (RMDs), and the optimal withdrawal strategy from various retirement accounts. Understanding the tax implications of each decision is crucial for maximizing retirement income and minimizing tax liabilities. Financial education in this area should focus on modeling different scenarios to project the most tax-efficient path for retirement income. Proactive adjustments to investment and retirement strategies based on these changes can help secure a more robust financial future.

Business Implications of the 2026 U.S. Tax Code

Businesses, regardless of size, will also feel the effects of the 2026 U.S. Tax Code. Changes to corporate tax rates, depreciation rules, and specific business deductions can significantly impact profitability and operational strategies. Business owners and financial managers must stay informed and adapt their financial education to navigate these complexities effectively.

The expiration of certain TCJA provisions could mean a return to higher corporate tax rates for some entities, or adjustments to pass-through deduction rules for others. This necessitates a thorough review of business structures, accounting practices, and future investment plans. Strategic financial education for businesses should focus on identifying potential tax liabilities and opportunities for tax savings, ensuring continued growth and stability.

Navigating Corporate and Pass-Through Entity Changes

Understanding how the 2026 tax code will distinguish between C-corporations, S-corporations, partnerships, and sole proprietorships is critical. Each entity type may face different implications, requiring tailored planning.

- Corporate Tax Rates: While the 21% corporate tax rate for C-corps was made permanent, other aspects affecting corporate taxation may still be subject to change or interpretation.

- Qualified Business Income (QBI) Deduction: The Section 199A QBI deduction, which benefits pass-through entities, is set to expire. Businesses relying on this deduction need to prepare for its potential absence.

- Depreciation Rules: Changes to bonus depreciation or Section 179 expensing could affect capital expenditure planning and the timing of asset purchases.

Beyond these specific changes, businesses should also evaluate how employee benefits, such as health insurance and retirement plans, are treated under the new tax code. Adjustments in these areas could impact both employee compensation strategies and the business’s overall tax burden. By integrating these considerations into their financial education, businesses can develop resilient strategies that not only comply with the new regulations but also leverage them for competitive advantage and sustained profitability. Proactive engagement with tax professionals is highly recommended to ensure all opportunities are identified and utilized.

Resources and Tools for Staying Informed

Staying informed about the evolving 2026 U.S. Tax Code is an ongoing process that requires access to reliable resources and effective tools. The financial landscape is dynamic, and regulations can be complex, making it essential to have trusted sources of information. A robust financial education strategy includes knowing where to find accurate updates and how to utilize tools that simplify tax planning.

Reliance on reputable government websites, financial news outlets, and professional tax organizations is crucial. These sources provide official guidance, expert analysis, and practical advice that can help individuals and businesses navigate the complexities of the tax code. Furthermore, leveraging technology through tax software and planning tools can significantly streamline the process of understanding and applying new regulations.

Essential Information Sources

Accessing official and expert-driven information is paramount for accurate tax planning. Avoid unverified sources that may offer misleading or incorrect advice.

- Internal Revenue Service (IRS): The official source for all U.S. tax laws, forms, publications, and guidance. Regular visits to IRS.gov are essential.

- Treasury Department: Provides insights into policy decisions and economic analyses that underpin tax legislation.

- Professional Tax Organizations: Organizations like the American Institute of CPAs (AICPA) and the National Association of Tax Professionals (NATP) offer expert analysis and educational resources.

- Reputable Financial News Outlets: Major financial news publications and websites often provide timely updates and interpretations of tax law changes.

In addition to informational sources, various software and digital tools can aid in tax planning. Tax preparation software, financial planning applications, and online calculators can help estimate tax liabilities, identify potential deductions, and model different financial scenarios. Many of these tools are updated annually to reflect the latest tax laws, making them invaluable for staying compliant and optimizing savings. By actively engaging with these resources and tools, individuals and businesses can maintain a high level of financial literacy and adaptability, ensuring they are well-prepared to master the 2026 U.S. Tax Code and achieve their savings goals.

| Key Point | Brief Description |

|---|---|

| TCJA Expirations | Key provisions from the 2017 Tax Cuts and Jobs Act are set to expire, impacting individual tax rates and deductions. |

| Financial Education | Crucial for understanding and applying new tax rules to optimize savings and minimize liabilities. |

| Tax-Advantaged Accounts | Leveraging 401(k)s, IRAs, and HSAs is vital for tax-efficient wealth growth and retirement planning. |

| Strategic Planning | Proactive evaluation of deductions, credits, and investment strategies to achieve a 15% savings boost. |

Frequently Asked Questions About the 2026 U.S. Tax Code

The most significant changes are primarily due to the expiration of many individual income tax provisions from the 2017 Tax Cuts and Jobs Act. This includes potential adjustments to tax rates, standard deduction amounts, and the reintroduction of personal exemptions, impacting most taxpayers.

Financial education empowers you to understand new regulations, identify applicable deductions and credits, and strategically use tax-advantaged accounts like 401(k)s and IRAs. This knowledge enables proactive planning to minimize your tax liability and boost savings.

Yes, the child tax credit is expected to revert to its pre-TCJA structure and value, potentially impacting many families. It’s crucial for parents to stay informed about the specific eligibility requirements and credit amounts for the upcoming tax year.

Businesses should review their entity structure, re-evaluate the impact of the Qualified Business Income (QBI) deduction’s expiration, and assess potential changes in corporate tax rates and depreciation rules. Consulting with a tax professional is highly recommended for tailored strategies.

Reliable sources include the official IRS website (IRS.gov), the U.S. Treasury Department, and professional tax organizations like the AICPA. Reputable financial news outlets also provide timely updates and expert analysis to help you stay informed.

Conclusion

The advent of the 2026 U.S. Tax Code presents both challenges and unparalleled opportunities for financial optimization. By proactively engaging in comprehensive financial education and strategic planning, individuals and businesses can navigate these changes effectively. Mastering the nuances of the new tax landscape, from understanding key expirations to leveraging tax-advantaged accounts and seeking professional guidance, is not just about compliance; it’s about unlocking significant savings potential. The goal of a 15% savings boost is achievable for those who commit to informed decision-making and continuous learning, ensuring a more secure and prosperous financial future.