IRS Tax Changes 2025: Business Guide to New Codes

The 2025 IRS tax code changes introduce significant shifts for businesses, impacting deductions, credits, and compliance requirements, necessitating proactive financial planning and expert consultation.

2025 Credit Card Annual Fees: Waivers & Reductions for $95+ Savings

This guide explores strategies for understanding and securing 2025 annual fee waivers and reductions on premium credit cards, offering practical advice to help consumers save $95 or more.

Dodd-Frank Act 2025 Revisions: What Financial Institutions Must Know

Financial institutions must proactively understand and prepare for the significant 2025 revisions to the Dodd-Frank Act, as these changes will profoundly impact regulatory compliance, operational strategies, and risk management frameworks across the sector.

Navigating 2025 Federal Reserve Interest Rate Hikes: A 3-Month Analysis

Understanding the potential impact of 2025 Federal Reserve interest rate hikes is crucial for proactive financial planning over the next three months, influencing everything from mortgages to market investments.

2025 Corporate Earnings Outlook: Sector Deep Dive

The 2025 corporate earnings outlook paints a complex picture, influenced by evolving economic conditions, technological advancements, and geopolitical factors, necessitating a granular sector-by-sector analysis for informed investment decisions.

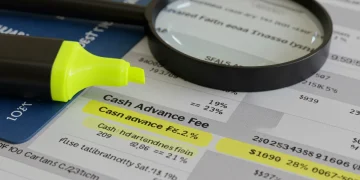

Credit Card Statements 2025: Spotting Cash Advance Fees

This guide helps you decode your 2025 credit card statement, focusing on how to identify and understand cash advance fees exceeding 2%. Equip yourself with the knowledge to protect your financial well-being.