Justice Department Investigates Credit Card Issuers for Anti-Competitive Practices

The Justice Department's March 2026 investigation into two large credit card issuers for alleged anti-competitive practices could result in fines up to $50 million, potentially reshaping the financial landscape and consumer credit options.

Freelancer Financial Education 2026: Retirement & 20% Savings

Freelancers in 2026 can achieve financial stability by prioritizing a robust retirement fund and consistently saving 20% of their income through strategic planning and disciplined execution.

2026 Bond Market: 0.5% Yield Curve Inversion Warning

The 2026 bond market faces a potential 0.5% yield curve inversion, a crucial signal often preceding economic slowdowns, necessitating careful investor consideration of portfolio adjustments and risk management strategies.

Maximize Credit Card Rewards 2026: 3-Month 15% Strategy

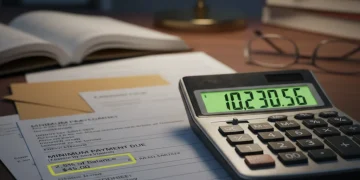

This article outlines a detailed 3-month strategy to significantly maximize credit card rewards by 15% in 2026. Discover how to strategically select cards, align spending with bonus categories, and utilize welcome offers for optimal financial gain.

New Federal Law P.L. 567 Restricts Credit Card Offers to Minors

New Federal Law P.L. 567, set to take effect in October 2026, will significantly restrict pre-approved credit card offers to minors, aiming to enhance financial protection for young individuals and prevent early debt accumulation.

Mastering 2026 US Tax Code: Boost Savings 15% with Education

Mastering the 2026 U.S. Tax Code is crucial for optimizing financial health, enabling individuals and businesses to leverage new regulations for a significant savings boost through strategic financial education.